Statement by James Love, KEI Director, on GOP proposal to eliminate the Orphan Drug Tax Credit.

The GOP proposal to eliminate the Orphan Drug Tax Credit may create a new opportunity to reform the incentives for rare diseases, even if the tax bill fails or the tax credit survives. The GOP tax bill shows there is weaker support for the existing regime than many thought.

The current tax credit is an important but often overlooked subsidy for drug developers. From 2010 to 2016, 75 percent of all novel cancer drugs approved by the US FDA qualified for the tax credit. Huge blockbuster drugs qualified for the orphan tax credit, without any transparency as to how much, and certainly provided no relief from high prices. An expensive orphan drug like Soliris now generates more than $800 million per quarter, and has earned $14 billion since its introduction. Humira has generated generated $103 billion in revenue since its introduction, and has benefited from five orphan designations and four orphan approvals.

The current pricing of drugs for rare diseases is arbitrary and unconnected to the amount of incentive needed to induce investments in the research necessary to bring the drugs to the market. The orphan drug tax credit is just part of what is a flawed framework for stimulating development of new drugs for rare diseases. The use of (or at least the term of) patent and regulatory monopolies are also appropriate to review, and to consider reforms that provide more cost effective incentives, protecting both innovation and access.

What might a deeper reform look like? While subsidies for trial costs are an appropriate way to stimulate development of new drugs for rare diseases, they need not be provided without conditions on pricing and access. KEI favors direct and transparent subsidies for trial costs, with the costs of the subsidies shared by more countries than the United States, and conditioned on measures that would address pricing and access.

A particularly appealing approach would be for the trial subsidies to be combined with large cash market entry rewards, as a replacement for the current system of non-transparent tax credits and temporary monopolies.

It’s worth noting that last year then GSK CEO Andrew Witty said full delinkage of R&D costs from drug prices was possible for rare diseases, and we agree with that assessment, even though we might not agree on the specific implementation of delinkage.

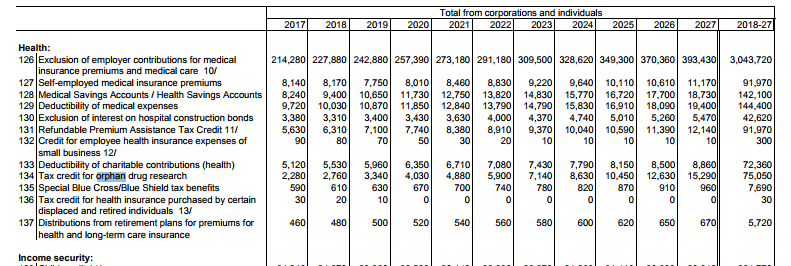

Treasure scored the Orphan Drug Tax Credit tax expenditure at $75 billion through 2027.