AIDS Drug Assistance Programs (ADAP) serve low-income, underinsured or uninsured HIV-positive patients in the United States and its territories. General eligibility requirements may include residency, clinical eligibility based on specific CD4 counts, and income. Specific eligibility criteria for each ADAP is determined by each individual state. The following data, which focuses on financial eligibility criteria and ADAP expenditures, has been compiled from the National Alliance of State and Territorial AIDS Directors (NASTAD’s) National ADAP Monitoring Project 2011 Annual Report and NASTAD’s ADAP watchlists.

Financial Eligibility Criteria

ADAP financial eligibility in the U.S. ranges from a low of 200 percent of the Federal Poverty Level (FPL) with respect to a patient’s gross income to a higher cutoff point of 500 percent.

The 2011 FPL was set at $10,890 (or $13,600 in Alaska and $12,540 in Hawaii) for a household of one person. For each additional person in the household, $3,820 is added to the base FPL of $10,890. Thus, for a household of one person, the ADAP financial eligibility ranges from a maximum gross income of $21,780 to a maximum gross income of $54,450 depending on the state of residency.

The largest group of ADAP clients currently served according to income level are those residing below the standard (100 percent of) the FPL, representing 45 percent of all ADAP clients in the U.S. and its territories in FY 2010.

With regard to the specific income limits for ADAP eligibility in the 50 United States and the District of Columbia (as of August 12, 2011):

- 8 states have financial eligibility of <250 percent: Arkansas, Idaho, Iowa, Nebraska, Oklahoma, Oregon, Texas, Vermont (VT eligibility is based off net income)

- 2 states have financial eligibility between 250 and 299 percent: Alabama, Utah

- 24 states have financial eligibility between 300 and 399 percent: Alaska, Arizona, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Louisiana, Minnesota, Missouri, Montana, New Hampshire, North Carolina, North Dakota (based off net income), Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Washington, West Virginia, Wisconsin, Wyoming

- 10 states have financial eligibility between 400 and 499 percent: California, Colorado, Connecticut (based of net income), Hawaii, Michigan, Nevada, New Mexico, New York, Rhode Island, Virginia

- 6 states (including the District of Columbia) have financial eligibility of 500 percent: Delaware, District of Columbia, Maine, Maryland, Massachusetts, New Jersey

- Mississippi did not report its ADAP data for FY 2010 and its eligibility criteria is unknown.

In addition to income limits, 14 states also have asset limits which range from $4,000 in Nevada to $25,000 in New York and DC. Other states imposing asset limits include: Delaware, Georgia, Iowa, Kentucky, Louisiana, Minnesota, New Mexico, Oregon, Tennessee, Utah and Washington. While some states exclude a “major residence,” one vehicle, or federally recognized retirement accounts, others do not provide for such exclusions and ownership of such items may preclude an individual from ADAP support.

In the last two years, numerous states have been forced to turn to cost-containment strategies including lowering financial eligibility. Arkansas, for example, reduced its financial eligibility from 500 to 200 percent FPL, resulting in the disenrollment of 99 clients in September of 2009. Illinois has twice lowered financial eligibility, ultimately going from 500 to 300 percent FPL. North Dakota reduced eligibility from 400 to 300 percent. Ohio reduced eligibility from 500 to 300 percent FPL, disenrolling 257 clients in July 2010. South Carolina went from a high of 550 FPL to 300 percent FPL. Utah reduced its financial eligibility from 400 to 250 perent FPL, disenrolling 89 clients in September 2009. In addition to the six states that have already significantly reduced financial eligibility–in the case of Arkansas, a greater than 50 percent reduction–due to increasing demands on ADAPs, other states, including Florida and Wyoming, are also considering lowering financial eligibility before March 31, 2012 (which is the end of the ADAP FY 2011).

As discussed previously, ADAPs are becoming increasingly impacted and states have resorted to placing HIV-positive patients on long and growing wait lists or have implemented other cost containment strategies. State ADAPs have been forced to enact these cost-containment strategies even after $25 million in ADAP emergency funding was allocated to address funding crises in 2010.

ADAP Expenditures and High Prescription Drug Costs

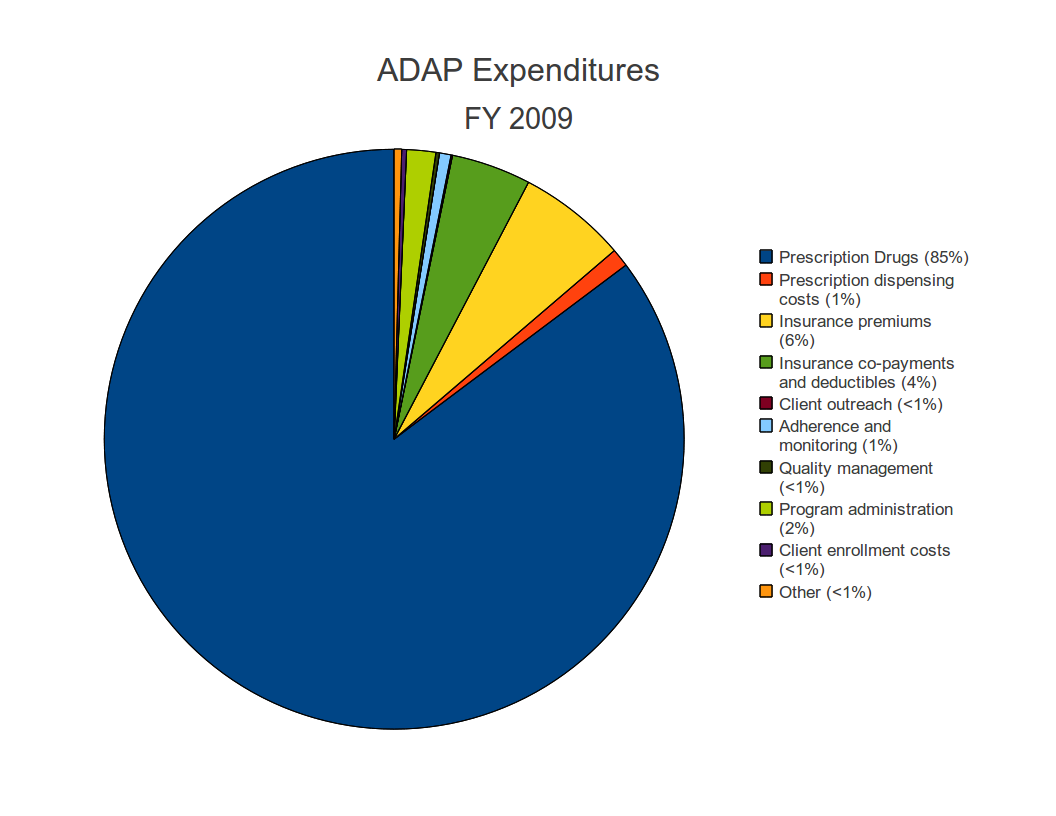

Prescription drug costs represent, by far, the greatest expenditure for ADAPs. In FY 2009, prescription drug expenditures for ADAPs totaled more than $1.43 billion, approximately 85 percent of total ADAP expenditures for the year. Prescription dispensing costs reached 1 percent of expenditures while insurance premiums, co-payments and deductibles combined represent an additional 10 percent of total ADAP expenditures in FY 2009. The remaining 4 percent of ADAP yearly expenditures in FY 2009 went to program administration, quality management, monitoring, client outreach and enrollment, or other costs including (but not limited to) contract services to dispense medications, determination of eligibility, pharmacy charges, shipping fees, and lab services.

The average monthly cost per ADAP client for drug expenditures varies from state to state, from a low of $30 per patient in New Mexico to a high of $2,286 per patient in Kansas. 19 states reported a greater than $1,000 average cost per client per month in June 2010. The total June 2010 drug expenditures for ADAPs was $146,457,975, serving 135,596 clients across the United States and its territories, or an average of $1080 monthly drug expenditure cost per patient.

The large and growing number of low-income, underinsured and uninsured HIV-positive patients in the United States coupled with high prescription drug prices has resulted in an increasingly under-funded program for treating HIV-positive clients.

The fact that 85 percent of all ADAP expenditures in FY 2009 went directly to the costs of prescription drugs and the fact 20 ADAPs cited escalating drug costs as a reason for implementing cost-containment strategies suggests that there is a need for new approaches to reduce the high costs of HIV/AIDS medicines.

The reforms proposed by Senator Sanders (I-VT) in S.1138, the Prize Fund for HIV/AIDS Act, would help address the funding shortages by lowering the overall costs of treatment for HIV/AIDS, dramatically reducing the costs of drugs on the margin and vastly expanding access, while simultaneously increasing innovation for these life-saving medicines.

S.1138 would provide more than $3 billion per year in rewards for companies that developed new AIDS drugs, but permit generic competition for products, lowering outlays on drugs by more than $7 billion per year domestically, with the net savings ($7 billion – $3 billion) shared by both health insurers and patients.

See: S.1138 overview.