IMS Health, the global information and technology services company, known for its statistics on sales of drugs, published a study in May 2015 that estimated the global market for oncology drugs now exceeds $100 billion per year.

The study, “Developments in Cancer Treatments, Market Dynamics, Patient Access and Value: Global Oncology Trend Report” – reviewed the marketplace dynamics for oncology-related pharmaceuticals and comments on patient access to new cancer drugs. [link here]

This from the report:

Global Oncology Trends Report 2015. Report by the IMS Institute for Healthcare Informatics.

. . . [snip]

Patient Access and Value

Patient access to oncology medicines varies widely by country and closer scrutiny is being placed on value by payers and patients who may face a growing share of treatment costs.

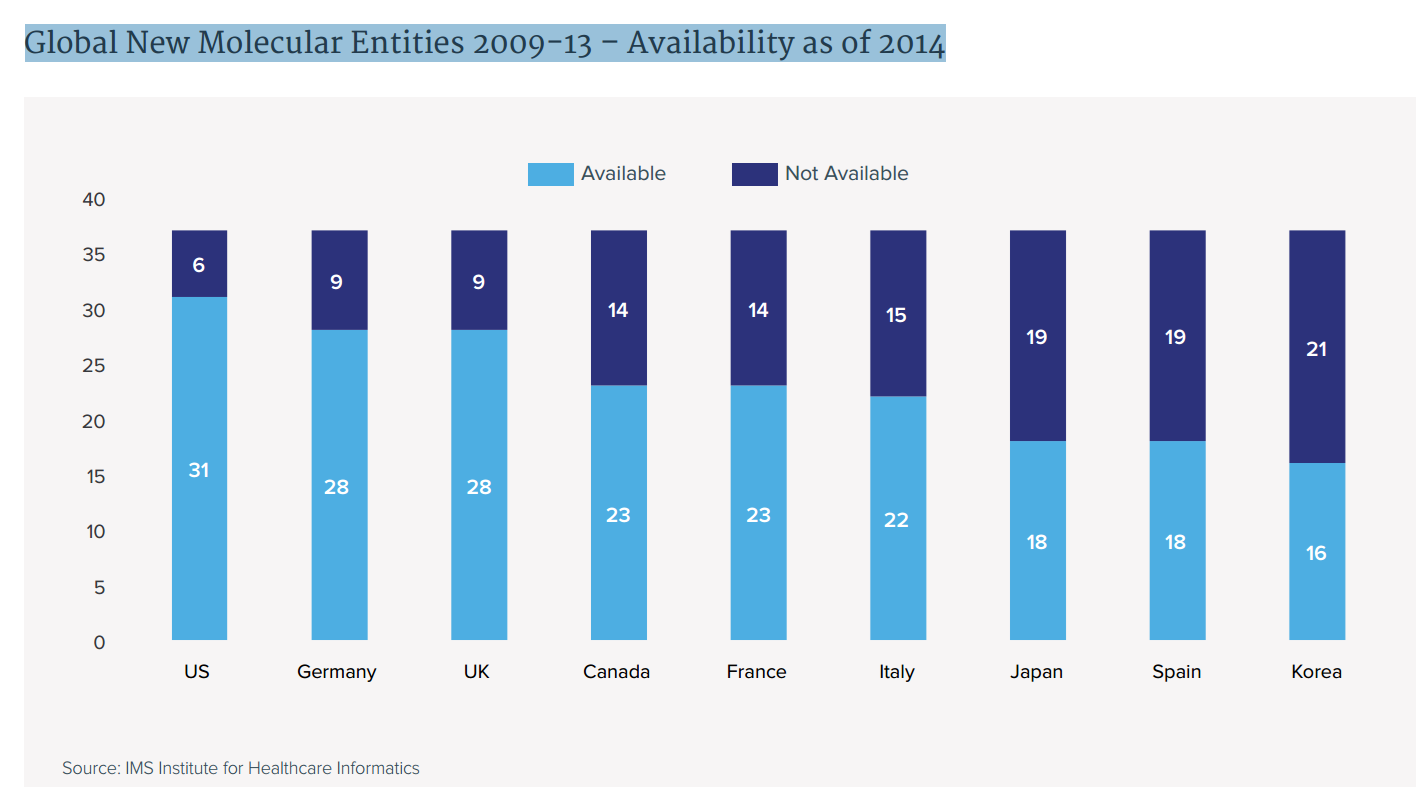

- The availability of new medicines varies widely across the major developed countries with patients in Japan, Spain and South Korea having access in 2014 to less than half of the new cancer drugs launched globally in the prior five years.

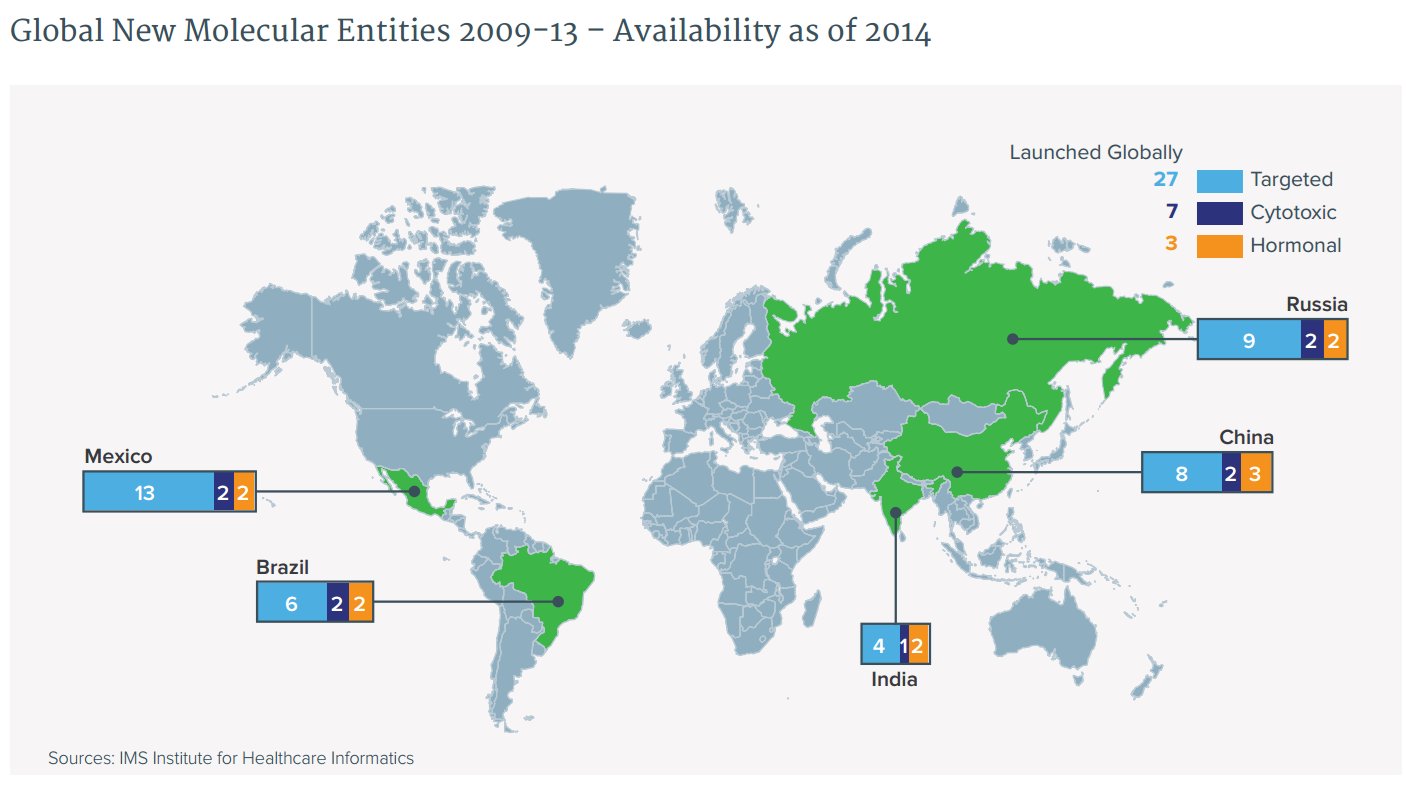

- In pharmerging markets, availability of newer targeted therapies remains low though increasing.

- Even when available, lack of reimbursement for drugs, particularly in countries employing formal cost effectiveness methodologies based upon cost per quality life year gained, constrains access for patients.

- Assessment of value for oncology products is becoming more complex as fewer new drugs have single indications and by 2020 it is expected most will have three or more indications.

- Divergence in clinical value by indication complicates assessments of appropriate pricing by payers since in many cases the majority of a drug’s clinical value may be in areas with small patient populations while most of its use is for indications with relatively less value.

- Overall therapy treatment costs per month have increased 39% over the past ten years in inflation adjusted terms, similar to the 42% increase in overall response rates and 45% increase in months that patients are on therapy, which also contribute to higher overall spending levels associated with improved survival rates.

- In the U.S., patient out of pocket costs associated with IV cancer drugs have risen steeply as consolidation of smaller group practices into larger hospital systems has triggered higher outpatient facility costs shared with patients.

- Patient concerns about the financial burden of living with cancer is a frequent topic of discussion on social media sites which are increasingly used as a source of information and for sharing experiences.

The availability of new medicines varies widely across the major developed markets

Global New Molecular Entities 2009-13 – Availability as of 2014

[snip]

Patients in pharmerging countries have less availability to newer targeted treatments

- Access is more limited in pharmerging countries than in developed countries.

- Across countries, a higher percentage of the new hormonal therapies are available than of the new cytotoxics or targeted therapies.

- In Brazil and Mexico, private insurers are more likely to reimburse new cancer drugs than public health systems, which remain less open to new products. Availability in China and India varies by region, and patients must frequently pay all or most of the cost for the newest drugs.

- The 2015 revision of the World Health Organization’s Essential Medicines List may result in the inclusion of targeted therapies and their increased availability across pharmerging countries.

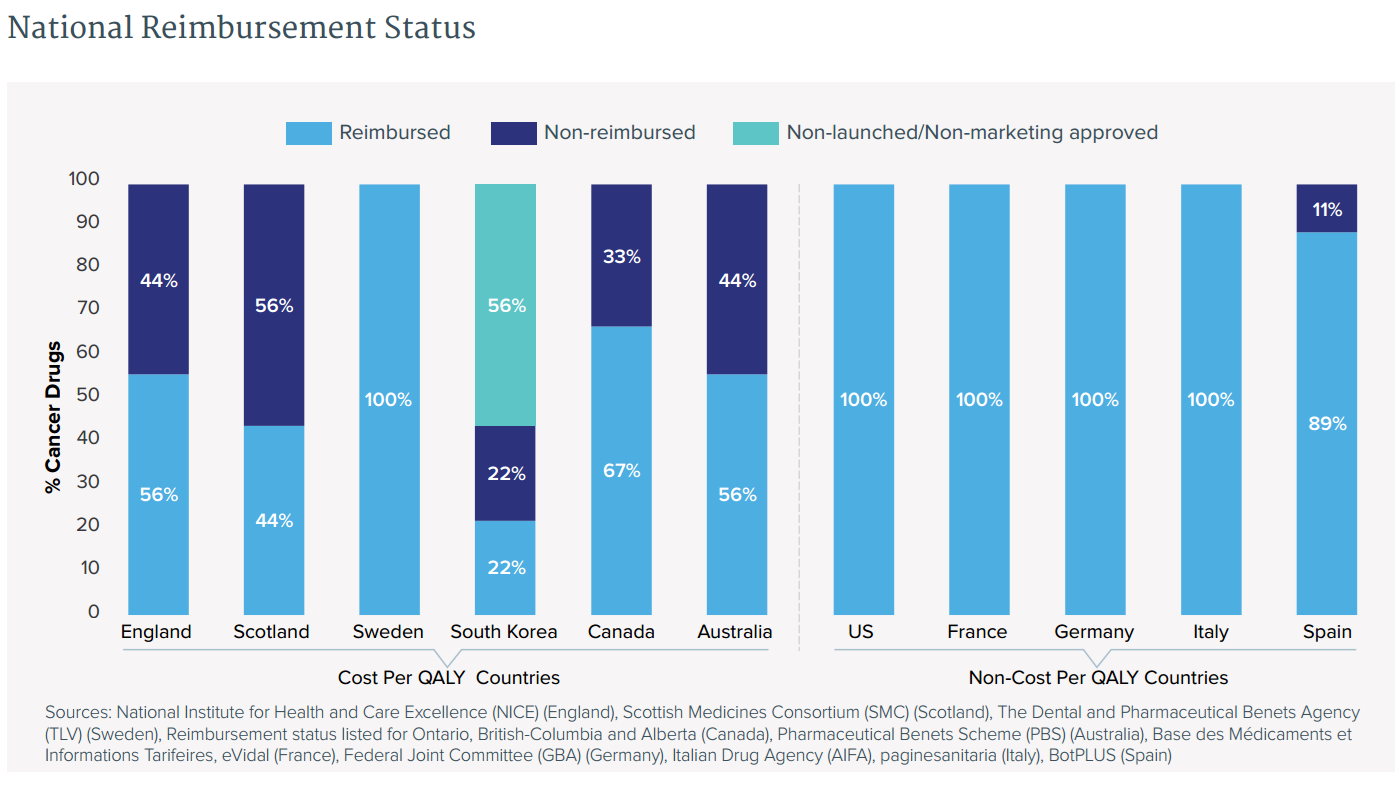

Even when available, lack of reimbursement for drugs constrains access for patients

. . .

- Access to new cancer drugs is not universal even in developed countries, where national health systems’ priorities may result in their declining to reimburse some products.

- While they reimburse most non-cancer drugs, countries employing a formal costeffectiveness methodology based upon cost per quality life year gained (cost per QALY, or CPQ) are much less likely to pay for new cancer drugs than countries employing other assessment approaches.

- Exclusion from access through normal health system channels does not universally mean that patients cannot arrange access: Australia, for example, operates a special fund to pay for trastuzumab for late-stage HER2+ breast cancer patients, while England’s Cancer Drug Fund (CDF) provides many products to individual patients who successfully apply for use outside the normal guidelines approved by the National Institute for Health and Care Excellence (NICE).

There is much more in the full IMS report.