The United States has proposed that some (but no means all) IPR obligations involving medicines be modified for countries with incomes below the amount the World Bank defines as “high.” The threshold to be considered a high income country was $12,616 in per capita income for 2012, and is adjusted every year. In contrast, the US per capita income was $50,124 in 2012. (More data here)

At present levels of income, this would create a lower standard for IPR for four of the 12 countries in the TPP, including Mexico, Malaysia, Peru, and Viet Nam. Mexico has indicated it may not even take advantage of the lower standards, if they are available. Malaysia is concerned that it may be reclassified in the not too distant future. Chile would not qualify for the concessions.

The current ratios of national per capita income to World Bank high income threshold are as follows:

- Australia: 4.72

- Brunei Darussalam (2009) : 2.59

- Canada: 4.04

- Chile: 1.13

- Japan: 3.79

- Mexico: 0.76

- Malaysia: 0.78

- New Zealand (2011): 2.45

- Peru: 0.47

- Singapore: 3.74

- United States: 3.97

- Vietnam: 0.11

Some countries have objected to the World Bank definition. Here KEI takes a closer look at how it is calculated.

According to the World Bank:.

The process of setting per capita income thresholds started with finding a stable relationship between a summary measure of well-being such as poverty incidence and infant mortality on the one hand and economic variables including per capita GNI estimated based on the Bank’s Atlas method on the other. Based on such a relationship and the annual availability of Bank’s resources, the original per capita income thresholds were established. Thereafter, the original thresholds have been updated every year to incorporate the effect of international inflation, which is now measured by the average inflation of Japan, the United Kingdom, the United States and the Euro Zone. Thus, the thresholds remain constant in real terms over time. . . . An explicit benchmark between the middle-income and high-income countries was established in 1989 at $6,000 per capita in 1987 prices.

According to this statement, in 1989, the World Bank decided that in 1987 prices, $6,000 average per capita income was “high,” and the only changes have been adjustments for the inflation rate of the US, Japan, the UK and the Euro Zone.

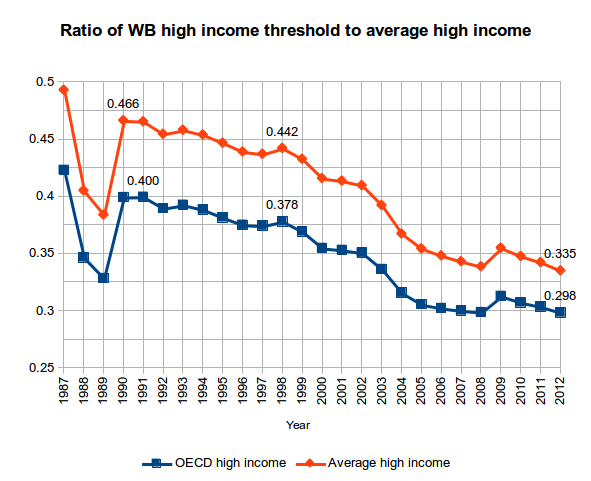

In past 26 years, the World has changed quite a bit. In 1987, the WB high income threshold was 49 percent of the average for all countries defined by the World Bank as high income, and 42 percent of the average for OECD high income countries. By 2000, this had fallen to 41 and 35 percent. In 2012, the World Bank threshold for a “high” income country had fallen to below 34 percent of the average for all countries defined as high income, and below 30 percent of the countries defined as OECD high income. Thus, the standards for qualifying as high income have slipped, in relative terms.

In 2012, the World Bank threshold for high income had fallen to 25 percent of US per capita income.

From the point of view of broader development objectives, the World Bank may or may not have compelling reasons to keep its 1989 formula. But as an indication of the ability to pay for medicines, this approach suffers, particularly for drugs for diseases like cancer, where global prices can be fairly flat.

The 1989 World Bank methodology takes 1987 average incomes, and then makes adjustments only for inflation. This might be more appropriate for a good for which the prices were increasing at roughly the rate of inflation. For pharmaceutical drugs, prices have often increased at rates higher than the general rate of inflation. Patented drugs are often if not generally priced according to a percieved capacity to pay, without regard to manufacturing or distribution costs, and thus changes in prices are more likely to be related to changes in GNI per capita, than to the general inflation rate.

The current World Bank methodology assumes that a “high” income has not changed in real terms since 1987. Sustained increases in real incomes will lead to any country reaching the 1987 standard, even if they lag far behind others with higher incomes. The World Bank formula also does not take into account any changes in the real price of medicines, a good for which prices are influenced by real incomes, including the real incomes of the very highest income countries, and, the highest income persons living in developing countries.

One can imagine a number of alternative standards for differential IPR treatment in the TPP. The World Bank income classification has the advantage of being well known, and sounding as though it is generous, by only applying the strongest IPR standards to countries that are not “high income.” The problem with the World Bank standard is that the standard has slipped so much, in relative terms, it no lower means what it did in 1987, or even 2000. One simple alternative would be to use a metric tied more directly to the average for high income countries, such as 50 percent of the average income for countries the World Bank considers high income, a metric that is close to the World Bank standard for 1987.

Ultimately, the USTR proposal is a crude effort to implement differential prices, operating on a very small set of parameters. In the longer run, countries have to push for the delinkage pardigm, where it is much easier to implement differential contributions to R&D costs, without having a negative impact on access.

Update:

I have proposed a new metric, here: https://www.keionline.org/node/1839